Industry Trends

De Beers hopes for diamond exploration rights in Angola by year-end

25/03/2014 / HITS:De Beers SA, the world’s largest diamond miner by market value, hopes to obtain a concession to explore in Angola by the end of this year, chief executive Philippe Mellier said.

The London-based company, majority-owned by global miner Anglo American PLC, is also holding initial talks with India about exploring in some areas in the centre-north of the country.

“We expect to have news about exploration licenses before the end of this year and we are in contact with the Angolan government to discuss that. We hope that it’s going to be successful,” Mellier told Reuters in an interview last week.

Early stage work in Angola should start later this year, a spokesman for the company added.

Russia’s Alrosa, De Beers’ main competitor, already operates the Catoca mine in Angola, the world’s fourth-largest, in a joint venture with Angola’s state-owned Endiama.

De Beers previously explored for diamonds in Angola between 2005 and 2012 but concluded that a stand-alone deposit in the area was not economic and relinquished its concession.

It is now going back to explore a new area in the country, which Mellier said was highly prospective.

Angola is the world’s fourth-largest diamond producer by value, and sixth by volume, and the government is keen to boost a sector where few companies are currently drilling. But the country needs to develop transport links and services for mining companies, and make geological data more accessible, according to a study published late last year.

ROUGH AND POLISHED

De Beers produced more than 31 million carats of diamonds last year at its existing operations in South Africa, Botswana, Namibia and Canada. The Botswana government owns 15 per cent of De Beers, while Anglo American owns the rest.

With underlying operating profit of just over $1-billion (U.S.) in 2013, the diamond miner was the third largest contributor to Anglo American’s earnings.

De Beers, which mines and distributes rough diamonds and also manufactures and sells diamond jewellery under its Forevermark brand, said rough diamond prices rose by about 2 to 3 per cent last year and have increased by a further 2 to 3 per cent this year.

Mellier, a French national who before joining De Beers as chief executive in 2011 held senior positions at Ford, Renault and Alstom, said sentiment was upbeat this month at the Hong Kong international diamond show, seen as a barometer of the health of the diamond industry.

“The Hong Kong show was pretty good, it was better than last year. We saw Chinese, Indians, Japanese were buying, and buying in good numbers,” he said.

“Expectations were high, because Chinese New Year was good and the first feedback I am getting is that it was in line with expectations or even better.”

He said he expected 4- to 4.5-per-cent growth in the dollar value of the world polished diamond market this year.

Retail sales of diamond jewellery were worth more than $72-billion in 2012 while rough diamond production generated revenue of around $15-billion, according to consulting firm Bain & Co., the latest available data.

The London-based company, majority-owned by global miner Anglo American PLC, is also holding initial talks with India about exploring in some areas in the centre-north of the country.

“We expect to have news about exploration licenses before the end of this year and we are in contact with the Angolan government to discuss that. We hope that it’s going to be successful,” Mellier told Reuters in an interview last week.

Early stage work in Angola should start later this year, a spokesman for the company added.

Russia’s Alrosa, De Beers’ main competitor, already operates the Catoca mine in Angola, the world’s fourth-largest, in a joint venture with Angola’s state-owned Endiama.

De Beers previously explored for diamonds in Angola between 2005 and 2012 but concluded that a stand-alone deposit in the area was not economic and relinquished its concession.

It is now going back to explore a new area in the country, which Mellier said was highly prospective.

Angola is the world’s fourth-largest diamond producer by value, and sixth by volume, and the government is keen to boost a sector where few companies are currently drilling. But the country needs to develop transport links and services for mining companies, and make geological data more accessible, according to a study published late last year.

ROUGH AND POLISHED

De Beers produced more than 31 million carats of diamonds last year at its existing operations in South Africa, Botswana, Namibia and Canada. The Botswana government owns 15 per cent of De Beers, while Anglo American owns the rest.

With underlying operating profit of just over $1-billion (U.S.) in 2013, the diamond miner was the third largest contributor to Anglo American’s earnings.

De Beers, which mines and distributes rough diamonds and also manufactures and sells diamond jewellery under its Forevermark brand, said rough diamond prices rose by about 2 to 3 per cent last year and have increased by a further 2 to 3 per cent this year.

Mellier, a French national who before joining De Beers as chief executive in 2011 held senior positions at Ford, Renault and Alstom, said sentiment was upbeat this month at the Hong Kong international diamond show, seen as a barometer of the health of the diamond industry.

“The Hong Kong show was pretty good, it was better than last year. We saw Chinese, Indians, Japanese were buying, and buying in good numbers,” he said.

“Expectations were high, because Chinese New Year was good and the first feedback I am getting is that it was in line with expectations or even better.”

He said he expected 4- to 4.5-per-cent growth in the dollar value of the world polished diamond market this year.

Retail sales of diamond jewellery were worth more than $72-billion in 2012 while rough diamond production generated revenue of around $15-billion, according to consulting firm Bain & Co., the latest available data.

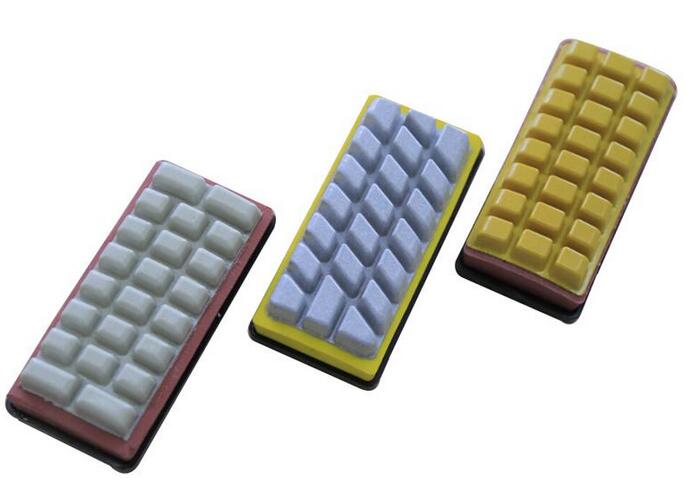

Diamond Fickert For Ceramic

Diamond Fickert was initially used for ceramic tiles polishing by Monte-Bianco in 2007 after ou...

Glaze Polishing Abrasive

Glaze polishing abrasives are used on normal polishing machines to make flexible full-polishing and ...

Diamond Wire Saw For Quarrying

Diamond wire saw for quarring is mainly used for quarrying granite and marble. Compared with the tra...

Diamond Wire Saw For Profiling

Diamond wire saw for profiling ...

Dry Squaring & Chamfering Wheel

Dry Squaring Wheel These dry squaring wheel products are suitable for make dry squaring on gla...

Metal Bond Diamond Squaring Wheel

Metal bond diamond disc squaring wheel is the most common used squaring tools for ceramic tiles edge...

Search News

Dimensional code scanner

Dimensional code scanner  Copyright © monte-bianco.com Guangdong ICP No. 05032889

Copyright © monte-bianco.com Guangdong ICP No. 05032889

Skype

Skype